What is Carbon Leakage, and How does it happen?

As European industry struggles to recover from the COVID-19 crisis and the impact of the war in Ukraine, the EU is trying to honour its climate commitments while keeping jobs and production chains at home.

Approximately 27% of global CO2 emissions from fuel combustion come from internationally traded goods, and emissions from EU imports have risen despite climate efforts.

Carbon leakage refers to the movement of production and associated emissions from one country to another due to less stringent carbon pricing and climate regulations in summary: ‘Carbon leakage is the shifting of greenhouse gas emitting industries outside the EU to avoid tighter standards.

Carbon leakage can undermine efforts to reduce global emissions and curtail private investment in decarbonisation.

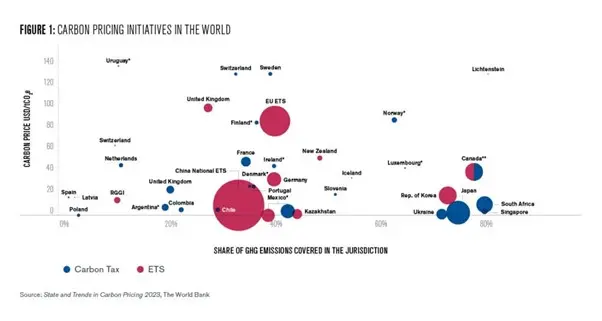

The issue of carbon leakage requires international measures to solve. The UK and many other countries worldwide are working towards reducing carbon leakage risk by pushing for ambitious climate action. In the last decade, initiatives to price carbon have flourished. However, progress on international solutions is time-consuming.

Therefore, the UK government consulted on a range of potential domestic carbon leakage mitigation measures. The consultation, ‘Addressing carbon leakage risk to support decarbonisation,’ ran from 30 March 2023 to 22 June 2023. It covered standards and other policy measures to help grow the market for low-emission products and emissions reporting that could broadly support the implementation of carbon leakage policy.

Unilateral carbon pricing does not align well with globalisation. Manufacturing firms operating in regulated jurisdictions must pay for their carbon dioxide and other greenhouse gas (GHG) emissions. Such regulation burden increases their cost, making them less competitive. These firms lose market share to competitors located in regions without carbon pricing. They export less and sell less domestically, as imported products become cheaper in comparison because they are not subject to the carbon price.

As a result, these firms are tempted to relocate their production plants abroad to avoid paying for their carbon emissions. This results in a domestic reduction of GHG emissions, partly offset by increased production in countries where emissions are unregulated - a phenomenon known as emissions leakage.

Significance of Carbon Pricing Initiatives

Carbon pricing initiatives to tackle climate change have recently flourished worldwide. Several jurisdictions have capped greenhouse gas emissions from industrial producers by setting up emissions trading schemes called “cap-and-trade.” Examples include the European Union’s Emission Trading Scheme (ETS), the Regional Greenhouse Gas Initiative in the northeastern United States, California’s and Quebec’s joint cap-and-trade program, and China’s ETS.

Companies in these jurisdictions must pay for their carbon emissions by buying emission allowances, increasing their production costs, and reducing their competitiveness relative to foreign firms. This creates an uneven playing field, with repercussions for international trade flows and the climate. In fact, unilateral carbon pricing may lead to carbon leakage. Since greenhouse gases emitted outside the border of the emission trading market are not capped, the emission reductions induced by the cap-and-trade regulation can be more than offset by an increase in emissions from foreign competitors.

Mitigating Carbon Leakage

Carbon leakage mitigation is possible using three policy tools.

- First, the cost burden due to the carbon price on domestic firms can be lowered with rebates and subsidies based on output, abatement efforts, or emission intensities.

- Second, a carbon border adjustment mechanism (CBAM) can level the cost of imported goods with a border charge.

- Third, the cost of exports can be reduced with rebates and subsidies on exported production.

The European Union (EU) has recently been adopting these policies in the context of its Green Deal initiative to tackle climate change. A CBAM entered its transitional phase in the EU in October 2023 on imports of selected industries (aluminium, cement, hydrogen, fertilizers, iron and steel, and electricity).

Imports are charged a carbon tax on their carbon footprint, equal to the average price of permits traded in the ETS. This CBAM will coexist with free allowances during a transitory period and eventually replace them.

Carbon Border Adjustment Mechanism (CBAM)

As of October 1, 2023, Regulation 2023/956 introduced the EU’s Carbon Border Adjustment Mechanism (CBAM). The objective is to put a fair price on carbon emitted during the production of goods imported into the EU and encourage cleaner industrial production through a methodology for calculating embedded emissions according to the Paris Agreement and the EU Fit for 55 package.

In 2026, the Carbon Border Adjustment Mechanism (CBAM) will begin to replace the free allowance policy for sectors such as cement, iron and steel, aluminium, fertilizers, electricity, and hydrogen. The transition from the free allowances system to CBAM will occur gradually over ten years. It will be implemented in phases and is aligned with the phase-out of the allocation of free allowances set in the EU Emissions Trading System (ETS).

This transitional period intends to:

- Serve as a pilot and learning phase for importers, producers, and authorities.

- Collect information on the emissions to refine the methodology for calculating embedded emissions.

- Bring the price of carbon produced in the EU inline with the price of carbon-intensive goods imported into the EU

Explaining explicit and effective carbon price

- An explicit carbon price puts a £/tCO2e directly on greenhouse gas emissions produced during manufacturing. These usually take the form of either an emissions trading scheme with a market-based price or a carbon tax with a fixed price.

- The effective carbon price is the price producers pay after accounting for the impact of free allowances and other support mechanisms.

- The UK CBAM will apply an effective carbon price to imports, significantly lower than the headline explicit UK ETS price, to reflect domestic free allowances. The EU’s Carbon Border Adjustment Mechanism (CBAM) is expected to be fully in place as of 2026, but initially, it will only apply to a certain number of products with a high risk of carbon leakage.

Which emissions categories will apply for a UK CBAM?

The UK CBAM will be applied to Scope 1 and 2 and select precursor product emissions embodied in imported products to ensure comparable coverage with the UK Emissions Trading Scheme.

Conclusion:

Climate change is a global concern addressed with local policies, such as carbon pricing and subsidies for low-carbon technologies. International trade can undermine the effectiveness of these local policies by increasing imports from countries with unregulated or lax climate policies, where firms produce with cheap and dirty technologies. Carbon leakage is an issue that needs to be addressed through complementary trade policies like the EU’s CBAM.

Despite its complexities, the CBAM has several properties that make it a good candidate to complement the EU ETS. It is consistent with the polluter-pays principle; by charging the EU ETS price per carbon emission embedded in imported goods, the CBAM levels the playing field within the EU.

The EU’s CBAM incentivises firms importing within the EU to reduce carbon emissions and encourages trading country partners with the EU to launch their carbon pricing. However, its implementation will be challenging. It started with the reporting of the embedded emissions during a pilot phase. Nevertheless, the EU’s CBAM is a first step in better coordination between climate and trade policies, and it could inspire other countries investing in decarbonisation.

Glossary:

Embodied emissions: Embodied Emissions are the greenhouse gas emissions related to product manufacture. Depending on the scope of emissions covered, this includes emissions related to the extraction and processing of raw materials and fuels, combustion of fuels, process emissions and end-of-life emissions.

Emissions Trading Scheme: The UK Emission Trading Scheme (ETS) is a cap-and-trade system that caps the total greenhouse gas emissions, creating a carbon market with a carbon price signal to incentivise decarbonisation. It went live on 1 January 2021, replacing the UK’s participation in the EU ETS. Under the Ireland/Northern Ireland Protocol, electricity generators in Northern Ireland remained within the EU ETS. The UK ETS promotes cost-effective decarbonisation, allowing businesses to cut carbon emissions where it is cheapest.

Free Allowances: To reduce the risk of carbon leakage, operators covered by the UK Emissions Trading Scheme (UK ETS) with a valid application and deemed at risk of carbon leakage are provided with a proportion of UK ETS Allowances for free.

CBAM liability: This is the amount paid on imports due to the CBAM. This accounts for the emissions embodied in the product, the UK’s effective carbon price and the carbon price applied overseas.